UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| Preliminary Proxy Statement | ||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| Definitive Proxy Statement | ||||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under Rule 14a-12 | |||

Stewart Information Services Corporation | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

PRELIMINARY PROXY MATERIAL

SUBJECT TO COMPLETION, DATED MARCH 6, 2015

Common nominees

STEWART INFORMATION SERVICES CORPORATION

1980 Post Oak Boulevard, Suite 800

Houston, Texas 77056

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 3, 20131, 2015

Notice is hereby given that Stewart Information Services Corporation, a Delaware corporation, will hold its annual meeting of stockholders on May 3, 2013,1, 2015, at 8:30 a.m., CDT, in the First Floor Conference Room of Three Post Oak Central, 1990 Post Oak Boulevard, Houston, Texas 77056, for the following purposes:

| (1) | To elect Stewart Information Services Corporation’s directors; |

| (2) | To approve an advisory resolution regarding the compensation of Stewart Information Services Corporation’s named executive officers; |

| (3) | To ratify the appointment of KPMG LLP as Stewart Information Services Corporation’s independent auditors for |

| (4) | To consider a stockholder advisory proposal described in the accompanying Proxy Statement, if properly presented at the 2015 annual meeting of stockholders; and |

| To transact such other business as may properly come before the meeting or any |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE:

| • | FOR the five nominees for director to be elected by the common stockholders, |

| • | FOR the approval of the advisory resolution regarding the compensation of Stewart Information Services Corporation’s named executive officers, and |

| • | FOR the ratification of KPMG LLP as Stewart Information Services Corporation’s independent auditors for |

The Board is making no recommendation regarding the stockholder advisory proposal relating to the conversion of the Class B common stock into common stock.

The holders of record of Stewart’s common stock and Class B common stock at the close of business on March 1, 20132, 2015 will be entitled to vote at the meeting.

By Order of the Board of Directors,

J. Allen Berryman

Secretary

March 28, 2013[—], 2015

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDERS’ MEETING TO BE HELD MAY 3, 20131, 2015

Our proxy statement for the 20132015 Annual Meeting and our Annual Report on Form 10-K

for the fiscal year ended December 31, 20122014 are available atwww.stewart.com/2013-annual-meeting.2015-annual-meeting

IMPORTANT

You are cordially invited to attend the annual meeting in person. Even if you plan to be present, you are

urged to sign, date and mail the enclosed proxy promptly. If you attend the meeting you can vote either in

person or by your proxy.

| 5 | ||||

Security Ownership of Certain Beneficial Owners and Management | ||||

| 52 | ||||

Annex A—Additional Information Regarding Participants in the Solicitation | A-1 | |||

SUBJECT TO COMPLETION, DATED MARCH 6, 2015

STEWART INFORMATION SERVICES CORPORATION

1980 Post Oak Boulevard, Suite 800

Houston, Texas 77056

(713) 625-8100

PROXY STATEMENT FOR THE ANNUAL

MEETING OF STOCKHOLDERS

To Be Held May 3, 20131, 2015

Except as otherwise specifically noted, the “Company,” “SISCO,” “Stewart,” “we,” “our,” “us,” and similar words in this proxy statement refer to Stewart Information Services Corporation.

Stewart Information Services Corporation is furnishing this proxy statement to our stockholders in connection with the solicitation by our board of directors (the “Board”) of proxies for the annual meeting of stockholders we are holding Friday, May 3, 2013,1, 2015, at 8:30 a.m., CDT, in the First Floor Conference Room of Three Post Oak Central, 1990 Post Oak Boulevard, Houston, Texas, 77056, or for any adjournmentadjournment(s) of that meeting. For directions to the annual meeting, please contact Ted C. JonesNat Otis in Investor Relations at (713) 625-8014.625-8360.

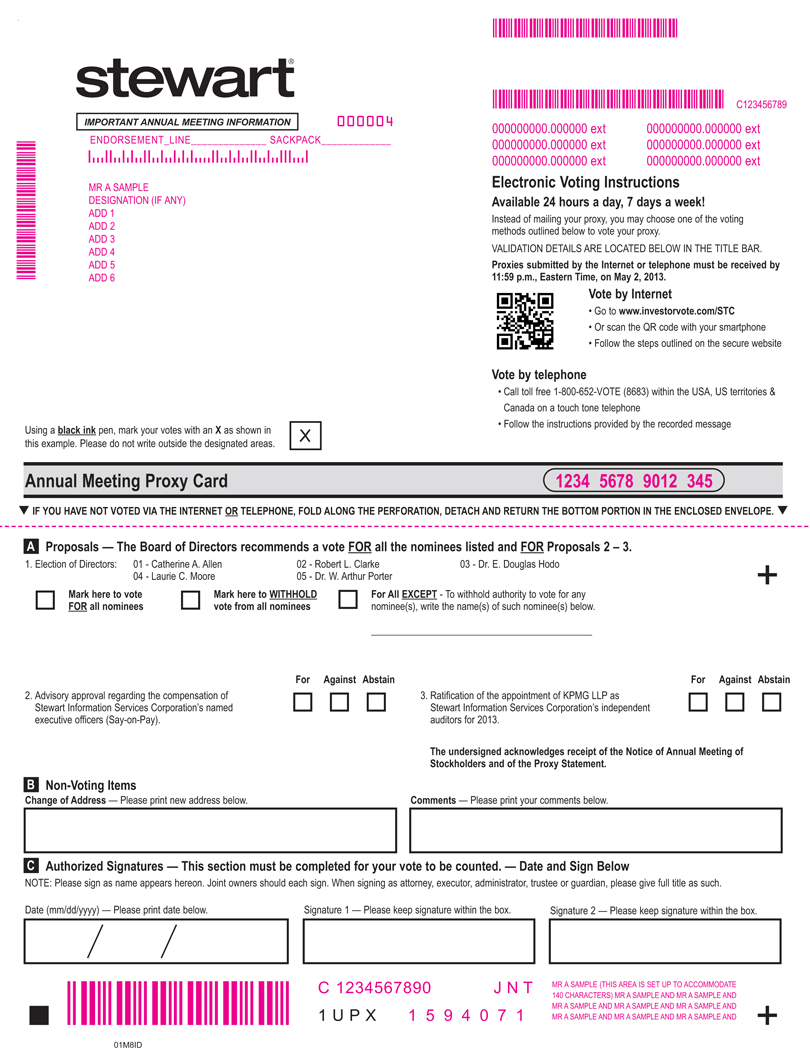

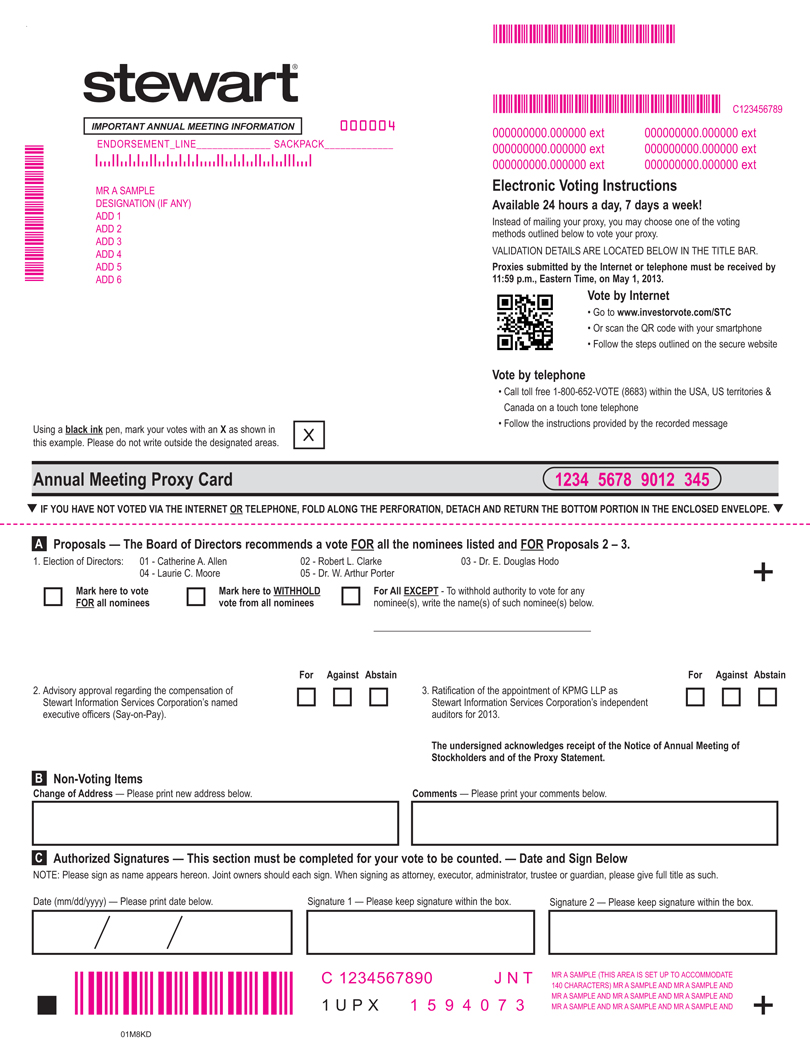

Proxies in the form enclosed, properly executed by stockholders and received in time for the meeting, will be voted as specified therein. Unless you specify otherwise, the shares represented by your proxy will be voted (i) for the board of directors’ nominees listed therein, (ii) for the approval of the advisory resolution regarding the compensation of Stewart Information Services Corporation’s named executive officers, and (iii) for the ratification of KPMG LLP as Stewart Information Services Corporation’s independent auditors for 2013.2015 and (iv) to abstain on the advisory stockholder proposal relating to the conversion of the Class B common stock into common stock. If after sending in your proxy you wish to vote in person or change your proxy instructions, you may before your proxy is voted deliver (i) a written notice revoking your proxy or (ii) a timely, later-dated proxy. Such notice or later-dated proxy shall be delivered either (i) in care of our Corporate Secretary, Stewart Information Services Corporation, 1980 Post Oak Boulevard, Suite 800, Houston, Texas 77056, or (ii) in person at the meeting. Please note that stockholders who hold their shares in our 401(k) plan must provide their voting instructions no later than 11:59 p.m., EDT, two days prior to the meeting. We are mailing this proxy statement on or about March 28, 2013,[—], 2015, to stockholders of record at the close of business on March 1, 2013.2, 2015.

At the close of business on March 1, 2013, 20,045,3072, 2015, 23,308,151 shares of our common stock (“Common Stock”) and 1,050,012 shares of our Class B common stock (“Class B Stock”) were outstanding and entitled to vote, and only the holders of record on such date may vote at the meeting. A quorum will exist if a majority of the holders of Common Stock and the majority of the holders of Class B Stock, issued and outstanding of each such class, and entitled to vote, are present in person or represented by proxy. We will count the shares held by each stockholder who is present in person or represented by proxy at the meeting to determine the presence of a quorum at the meeting. AsPer our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), as long as 600,000 or more shares of Class B Stock are outstanding, the Common Stock and Class B Stock will be voted as separate classes at each election of directors. Holders of our Class B Stock, whom we refer to as our Class B Stockholders, may convert their shares of Class B Stock into shares of our Common Stock on a one-for-one basis at any time.

The holders of our Common Stock, whom we refer to as our Common Stockholders, voting as a class, are entitledrequired to elect five of our nine directors. Each Common Stockholder iswill be entitled either to cast one vote per share for or against each of those five directors, or to vote cumulatively by casting five votes per share, which may be distributed in any manner among any number of the nominees for director. The enclosed form of proxy allows you to vote for all of the nominees listed therein, to withhold authority to vote for one or more of such nominees, or to withhold authority to vote for all of suchdirector nominees. If you withhold authority to vote for four or fewer of the nominees, and if there are nominees other than those nominated by the board of directors for the director positions to be elected by the Common Stockholders as listed in this proxy statement, then the persons named in the enclosed proxy may vote cumulatively by dividing the number of votes represented by the proxy equally among the nominees for whom you did not withhold authority to vote. If there are no nominees other than those nominated by the board of directors for the five positions to be elected by the Common Stockholders, the persons named in the enclosed proxy intend to allocate the votes represented by the proxy evenly among the nominees chosen by the board of directors as listed in this proxy statement. If there are any additional nominees for such positions, the persons named in the enclosed proxy will vote cumulatively to elect as many as possible of the nominees chosen by the board of directors. If it is not possible to elect each of the five nominees chosen by the board of directors, the persons named in the enclosed proxy will have discretion as to how they allocate the votes among the Company nominees chosen by the board of directors.

Unless there are director nominees other than those nominated by the board of directors, withholdinga director nominee will be elected as a director if the votes cast for his or her election exceed votes cast against his or her election. In

this case, any director nominee who does not receive a majority of authorityvotes cast “for” his or her election would be required to vote intender his or her resignation following the enclosed proxy will not affectfailure to receive the election of those directors for whom you withhold authorityrequired vote. Pursuant to vote because ourthe Company’s Amended and Restated By-Laws provide(the “By-Laws”), if the Secretary of the Corporation determines that the number of director nominees exceeds the number of directors areto be elected byas of the date seven days prior to the scheduled mailing date of the proxy statement, a plurality voting standard will apply and a director nominee receiving a plurality of votes cast will be elected as a director. Because Bulldog Investors, LLC and certain of its affiliates (together, “Bulldog”) have advised the shares voted in person or by proxy.Company of its intention to nominate five alternative director nominees for election at the 2015 annual meeting of stockholders (the “2015 Annual Meeting”) more than seven days prior to the scheduled mailing of this proxy statement, the standard for election of directors to the Board at the 2015 Annual Meeting will be a plurality vote if Bulldog proceeds with nominating five alternative director nominees. For the purpose of electing directors, broker non-votes and abstentions are not treated as a vote cast affirmatively or negatively, and therefore will not affect the outcome of the election of directors. Both abstentions and broker non-votes are counted for purposes of determining the presence of a quorum.

Our Class B Stockholders, voting as a class, are entitledrequired by the Certificate of Incorporation to elect the remaining four of our nine directors. Each Class B Stockholder has the right to vote, in person or by proxy, the number of shares it owns for those four directors for whose election it has a right to vote.

Our Common Stockholders and Class B Stockholders will vote together as a single class with respect to the approval of the advisory resolution regarding the compensation of our named executive officers. Approval of this proposal requires the affirmative vote of the majority of the shares voted at the meeting. Brokers do not have discretionary authority to vote shares on the proposal without direction from the beneficial owner. Broker non-votes will not be counted. Abstentions, which will be counted as shares present for purposes of determining a quorum, will not be considered in determining the results of the voting for this proposal. Your shares will be voted as you specify on your proxy. If your properly executed proxy does not specify how you want your shares voted, the shares represented by your proxy will be voted “FOR” the approval of this proposal.

Our Common Stockholders and Class B Stockholders will vote together as a single class with respect to the ratification of the appointment of KPMG LLP as our independent auditors for 2013.2015. The ratification of this proposal requires the affirmative vote of the majority of the shares voted at the meeting. Under New York Stock Exchange (“NYSE”) rules, the approval of our independent auditors is considered a routine matter, which means that brokerage firms may vote in their discretion on this proposal if the beneficial owners do not provide the brokerage firms with voting instructions. Abstentions, which will be counted as shares present for purposes of determining a quorum, will not be considered in determining the results of the voting for this proposal. Your shares will be voted as you specify on your proxy. If your properly executed proxy does not specify how you want your shares voted, wethe shares represented by your proxy will vote thembe voted “FOR” the approval of this proposal.

ExceptOur Common Stockholders and Class B Stockholders will vote together as otherwise specifically noted,a single class with respect to the “Company,” “SISCO,” “we,” “our,” “us,”stockholder advisory proposal relating to the conversion of Class B Stock into Common Stock. Approval of this stockholder advisory proposal requires the affirmative vote of the majority of the shares voted at the meeting. Approval of the stockholder advisory proposal would not itself eliminate the Company’s dual class capital structure, but rather it would be an advisory recommendation to the Board to submit such a proposal to the stockholders in the future. Brokers do not have discretionary authority to vote shares on the stockholder advisory proposal without direction from the beneficial owner. Broker non-votes will not be counted. Abstentions, which will be counted as shares present for purposes of determining a quorum, will not be considered in determining the results of the voting for this stockholder advisory proposal. Your shares will be voted as you specify on your proxy. If your properly executed proxy does not specify how you want your shares voted, the shares represented by your proxy will be voted “ABSTAIN” with respect to this stockholder advisory proposal.

You may receive solicitation materials from a dissident stockholder, Bulldog Investors, LLC, Opportunity Partners L.P. and similar wordscertain of their affiliates, seeking your proxy to vote for James Chadwick,

Gerald Hellerman, Richard Latto, Andrew Dakos and Phillip Goldstein to become members of the board of directors and a stockholder advisory proposal relating to the conversion of the Class B Stock into Common Stock. YOUR BOARD OF DIRECTORS URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY BULLDOG. YOUR BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF THE FOLLOWING BOARD NOMINEES: ARNAUD AJDLER, GLENN C. CHRISTENSON, ROBERT L. CLARKE, LAURIE C. MOORE, AND DR. W. ARTHUR PORTER ON THE ENCLOSEDWHITE PROXY CARD.

YOUR VOTE IS EXTREMELY IMPORTANT THIS YEAR IN LIGHT OF THE PROXY CONTEST BEING CONDUCTED BY BULLDOG.

Whether or not you plan to attend the meeting, and whatever the number of shares you own, please complete, sign, date and promptly return the enclosed WHITE proxy card. Please use the accompanying envelope, which requires no postage if mailed in the United States. If you own shares in “street name” through a bank, broker or other nominee, you may vote your shares by telephone or Internet by following the instructions on the proxy card. Please note, however, that if you wish to vote in person at the meeting and your shares are held of record by a broker, bank or other nominee, you must obtain a “legal” proxy issued in your name from that record holder.

YOUR BOARD OF DIRECTORS URGES YOU NOT TO SIGN ANY [COLOR] PROXY CARD SENT TO YOU BY BULLDOG. IF YOU HAVE PREVIOUSLY SIGNED A [COLOR] PROXY CARD SENT TO YOU BY BULLDOG, YOU CAN REVOKE IT BY SIGNING, DATING AND MAILING THE ENCLOSED WHITE PROXY CARD IN THE ENVELOPE PROVIDED. ONLY YOUR LATEST DATED PROXY WILL BE COUNTED.

Receipt of Multiple Proxy Cards

Many of our stockholders hold their shares in more than one account and may receive separate proxy cards or voting instructions forms for each of those accounts. To ensure that all of your shares are represented at the 2015 Annual Meeting, we recommend that you vote every WHITE proxy card you receive.

Additionally, please note that Bulldog has stated its intention to nominate five (5) alternative director nominees for election at the 2015 Annual Meeting and submitted a stockholder advisory proposal relating to the conversion of the Class B Stock into Common Stock. If Bulldog proceeds with its alternative nominations and stockholder advisory proposal to eliminate the dual classes of stock, you may receive proxy solicitation materials from Bulldog, including an opposition proxy statement and a [color] proxy card. Your board of directors unanimously recommends that you disregard and do not return any [color] proxy card you receive from Bulldog.

If you have already voted using Bulldog’s [color] proxy card, you have every right to change your vote and revoke your prior proxy by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone by following the instructions provided on the enclosed WHITE proxy card. Only the latest dated proxy you submit will be counted. If you withhold your vote on any Bulldog nominee using Bulldog’s [color] proxy card, your vote will not be counted as a vote for the Board’s nominees and will result in the revocation of any previous vote you may have cast on our WHITE proxy card. Accordingly, if you wish to vote pursuant to the recommendation of our Board, you should disregard any proxy card that you receive that is not a WHITE proxy card.

Revocation of Proxies

If you have previously signed a [color] proxy card sent to you by Bulldog, you may change your vote and revoke your prior proxy by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone by following the instructions on the enclosed WHITE proxy card. Submitting a Bulldog [color] proxy card—even if you withhold your vote on the

Bulldog nominees—will revoke any votes you previously made via our WHITE proxy card. Accordingly, if you wish to vote pursuant to the recommendation of our Board for the election of directors and any other proposals, you should disregard any proxy card that you receive that is not a WHITE proxy card and do not return any [color] proxy card that you may receive from Bulldog, even as a protest vote against Bulldog.

Cost of Solicitation

We will bear the cost of the solicitation of our proxies. In addition to mail and e-mail, proxies may be solicited personally, via the Internet or by telephone or facsimile, by a few of our regular employees without additional compensation. We will reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their expenses for forwarding proxy materials to principals and beneficial owners and obtaining their proxies. As a result of the potential proxy solicitation by Bulldog, we may incur additional costs in connection with our solicitation of proxies. We have hired Innisfree M&A Incorporated (“Innisfree”), 501 Madison Avenue, 20th Floor, New York, NY 10022 to assist us in the solicitation of proxies for a fee of up to $[—] plus out-of-pocket expenses. Innisfree expects that approximately [—] of its employees will assist in the solicitation. Our expenses related to the solicitation of proxies from stockholders this year will significantly exceed those normally spent for an annual meeting of stockholders. Such costs are expected to aggregate approximately $[—]. These additional solicitation costs are expected to include the fee payable to our proxy solicitor; fees of outside counsel and other advisors to advise the Company in connection with a contested solicitation of proxies; increased mailing costs, such as the costs of additional mailings of solicitation material to stockholders, including printing costs, mailing costs and the reimbursement of reasonable expenses of banks, brokerage houses and other agents incurred in forwarding solicitation materials to principals and beneficial owners of our Common Stock, as described above; and possibly the costs of retaining an independent inspector of election. To date, we have incurred approximately $[—] of these solicitation costs.

Certain Information Regarding Participants in the Solicitation of Proxies

Under applicable SEC regulations, members of the Company’s board of directors are “participants” and certain executive officers and employees may be deemed to be “participants” in the Company’s solicitation of proxies in connection with the 2015 Annual Meeting. Certain required information regarding these “participants” is set forth in Annex A to this proxy statement referstatement.

Questions

If you have any questions or need assistance in voting your shares, please call Innisfree, the firm assisting us in the solicitation, at 877-825-8772.

BACKGROUND OF THE SOLICITATION

On February 12, 2014, the Company entered into a nomination and standstill agreement with Foundation Onshore Fund, L.P., Foundation Offshore Master Fund, Ltd., Foundation Offshore Fund, Ltd., Foundation Asset Management GP, LLC, Foundation Asset Management, LLC, David Charney, Sky Wilber, Engine Capital, L.P., Engine Jet Capital, L.P., Engine Capital Management, LLC, Engine Investments, LLC, Arnaud Ajdler and Glenn Christenson pertaining to, Stewart Information Services Corporation.among other things, the election of directors to the Company’s Board at the Company’s 2014 annual meeting of stockholders, and the formation of an advisory committee to oversee the Company’s cost-reduction initiatives and review the Company’s operations. Pursuant to the nomination and standstill agreement, the Board nominated Arnaud Ajdler and Glenn Christenson as independent directors at the 2014 annual meeting of stockholders on the Company’s slate and formed an advisory committee of three directors to review the Company’s cost-cutting initiatives. The nomination and standstill agreement terminated pursuant to its terms on February 2, 2015, ten business days before the expiration of the Company’s advance notice deadline for the nomination of directors or submission of proposals at the 2015 Annual Meeting.

On February 6, 2015, Foundation Asset Management, LP (“Foundation”) wrote a letter to current directors Arnaud Ajdler and Glenn C. Christenson inviting both directors to join a possible Foundation slate of nominees for election as directors at the 2015 Annual Meeting. The letter advised Mr. Ajdler and Mr. Christenson that Foundation would not object to their service on both the Company’s and Foundation’s slates for the 2015 Annual Meeting.

On February 5, 2015, Phillip Goldstein of Bulldog requested that the Board extend the deadline for nominating directors to be elected at the 2015 Annual Meeting.

On February 9, 2015, the Board replied to Mr. Goldstein’s request and declined to extend the February 15, 2015 deadline. However, the Board emphasized that it was interested in discussing Mr. Goldstein’s suggestions for the Company and stressed its desire to engage in a constructive dialogue. The Board also noted its belief that a distracting and costly proxy contest is not in the best interests of the Company or its stockholders, especially given the Company’s operational focus on implementing the Board’s cost cutting program and the mandatory Consumer Financial Protection Bureau’s mortgage disclosure rule, which goes into effect on August 1, 2015.

In early February, 2015, the Company informed Mr. Ajdler and Mr. Christenson that the Board was inclined to renominate them for election as directors at the 2015 Annual Meeting but was not so inclined if they were also included as nominees on a slate of directors put forth by Foundation. Mr. Ajdler and Mr. Christenson both agreed not to be nominated on any slate of directors that might be put forth by Foundation and have agreed to be renominated on the Company’s slate of directors for the 2015 Annual Meeting.

On February 12, 2015, Mr. Goldstein, General Partner of Bulldog Investors LLC, wrote a letter to the Company on behalf of Opportunity Partners L.P., a fund managed by Bulldog Investors LLC (“Opportunity”), notifying the Company of Opportunity’s intent to nominate James Chadwick, Gerald Hellerman, Richard Latto, Andrew Dakos and Phillip Goldstein for election as directors at the 2015 Annual Meeting. In the letter, Mr. Goldstein also notified the Company of Opportunity’s intent to submit a stockholder advisory proposal relating to the conversion of the Class B Stock into Common Stock. Finally, Mr. Goldstein noted Opportunity’s belief that the best way to maximize stockholder value is via a sale of the Company and indicated that Opportunity was willing to have a substantive discussion with Thomas G. Apel, the Chairman of the Board, and other directors or officers of the Company.

The Company did not receive a nomination notice from Foundation by the February 15th deadline.

On February 16, 2015, Chief Executive Officer Matthew W. Morris Thomas G. Apel, the Company’s Chairman of the Board and Nat Otis, Director of Investor Relations, spoke with Mr. Goldstein regarding his February 12th letter. During such discussion, Mr. Goldstein suggested that the Company institute a $2.50 per share annual dividend.

On February 18, 2015, the Board met to discuss Opportunity’s nomination of a slate of five directors for election at the 2015 Annual Meeting and request for a $2.50 per share dividend.

On February 19, 2015, Mr. Morris Mr. Apel and Mr. Otis spoke with Mr. Goldstein and Mr. Dakos to further discuss the issues raised in Opportunity’s February 12th letter and its request for an increased dividend. Mr. Goldstein and Mr. Dakos focused on the Company’s capital allocation policy, specifically reiterating the request for the institution of a $2.50 per share dividend. Mr. Morris said he would discuss the issue with the Board, and suggested that the Company might be prepared to increase its dividend payment so that the Company’s payout ratio would be consistent with the payout ratios of its peers. Mr. Morris noted certain factors that would prohibit the Company from paying a $2.50 per share dividend and indicated that he would continue discussions with Mr. Goldstein.

On February 23, 2015, the Board met to discuss, among other things, the recent discussions with Mr. Goldstein. At the meeting, Goldman, Sachs & Co., the Company’s financial advisor, presented to the Board an analysis with respect to capital allocation and dividend policy. At the meeting, the Board authorized Mr. Morris to continue settlement discussions with Opportunity and, if such settlement discussions did not result in a resolution, to publicly announce a dividend increase to be paid quarterly beginning in the second quarter of 2015.

On February 23, 2015, Mr. Morris, Mr. Apel, Mr. Otis and John L. Killea, the Company’s Chief Legal Officer, spoke with Mr. Goldstein and Mr. Dakos regarding potential settlement terms. Mr. Morris indicated the Board’s receptiveness to increasing its dividend per share annually, but explained constraints on the Company that prevent it from increasing its annual dividend to $2.50 per share, as Opportunity had previously demanded. Mr. Goldstein and Mr. Dakos requested that the group discuss the Company’s proposal the following day.

On February 24, 2015, Mr. Goldstein, and Mr. Dakos spoke with Mr. Morris, Mr. Apel, Mr. Otis and Mr. Killea regarding the Company’s potential dividend increase and advised the Company that Opportunity intended to proceed with its proxy contest.

On February 25, 2015, the Company issued a press release announcing that it was increasing its cash dividend from $0.10 annually to $1.00 per share annually to be paid quarterly at a rate of $0.25 per share beginning in the second quarter of the year.

On February 26, 2015, Bulldog, on behalf of itself and certain affiliates filed a Schedule 13D publicly announcing its intention to nominate five candidates at the 2015 Annual Meeting and to present a stockholder advisory proposal recommending the Board submit a proposal to stockholders relating to the conversion of the Class B Stock into Common Stock. Bulldog disclosed a collective beneficial ownership of 1,154,289 shares of Common Stock. On this same day, the Company issued a press release relating to, among other things, the Bulldog nomination.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 1, 20132, 2015 with respect to persons we believe to be the beneficial owners of more than 5% of either class of our voting shares:

Name | �� | Title of Class | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

Matthew W. Morris | Class B Common Stock | 250,000 | 23.8 | |||||||

1980 Post Oak Boulevard | ||||||||||

Houston, Texas 77056 | ||||||||||

Morris Children Heritage Trust | Class B Common Stock | 246,852 | (1) | 23.5 | ||||||

1980 Post Oak Boulevard | ||||||||||

Houston, Texas 77056 | ||||||||||

Stewart Security Capital LP. | Class B Common Stock | 495,006 | (2) | 47.1 | ||||||

1980 Post Oak Boulevard | ||||||||||

Houston, Texas 77056 | ||||||||||

Dimensional Fund Advisors LP | Common Stock | 1,553,337 | (3) | 7.7 | ||||||

Palisades West, Building One | ||||||||||

6300 Bee Cave Road | ||||||||||

Austin, Texas 78746 | ||||||||||

BlackRock Inc. | Common Stock | 1,459,396 | (4) | 7.3 | ||||||

40 East 52nd Street | ||||||||||

New York, New York 10022 | ||||||||||

Whitebox Advisors, LLC | Common Stock | 1,378,180 | (5) | 6.8 | ||||||

3033 Excelsior Boulevard | ||||||||||

Minneapolis, Minnesota 55416 | ||||||||||

Manulife Financial Corporation | Common Stock | 1,289,248 | (6) | 6.4 | ||||||

200 Bloor Street East | ||||||||||

Toronto, Ontario, Canada M4W 1E5 | ||||||||||

Manulife Asset Management (US) LLC | Common Stock | 1,283,556 | (7) | 6.4 | ||||||

101 Huntington Avenue | ||||||||||

Boston, MA 02199 | ||||||||||

The Vanguard Group | Common Stock | 1,117,054 | (8) | 5.6 | ||||||

100 Vanguard Blvd. | ||||||||||

Malvern, PA 19355 | ||||||||||

Name | Title of Class | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||

Matthew W. Morris | Class B Common Stock | 250,000 | 23.6 | |||||||

1980 Post Oak Boulevard | ||||||||||

Houston, Texas 77056 | ||||||||||

Morris Children Heritage Trust | Class B Common Stock | 246,852 | (1) | 23.3 | ||||||

1980 Post Oak Boulevard | ||||||||||

Houston, Texas 77056 | ||||||||||

Stewart Security Capital LP | Class B Common Stock | 495,006 | (2) | 46.7 | ||||||

1980 Post Oak Boulevard | ||||||||||

Houston, Texas 77056 | ||||||||||

BlackRock, Inc. | Common Stock | 1,976,246 | (3) | 8.5 | ||||||

55 East 52nd Street | ||||||||||

New York, New York 10055 | ||||||||||

Dimensional Fund Advisors LP | Common Stock | 1,778,187 | (4) | 7.6 | ||||||

Palisades West, Building One | ||||||||||

6300 Bee Cave Road | ||||||||||

Austin, Texas 78746 | ||||||||||

Foundation Asset Management, LLC | Common Stock | 1,617,666 | (5) | 6.9 | ||||||

81 Main Street, Suite 306 | ||||||||||

White Plains, NY 10601 | ||||||||||

Thompson, Siegel & Walmsley LLC | Common Stock | 1,247,332 | (6) | 5.4 | ||||||

6806 Paragon Place, Suite 300 | ||||||||||

Richmond, Virginia 23230 | ||||||||||

Hirzel Capital Management LLC | Common Stock | 1,223,062 | (7) | 5.2 | ||||||

3963 Maple Avenue, Suite 170 | ||||||||||

Dallas, Texas 75219 | ||||||||||

Bulldog Investors, LLC | Common Stock | 1,154,289 | (8) | 5.0 | ||||||

Park 80 West—Plaza Two | ||||||||||

250 Pehle Avenue, Suite 708 | ||||||||||

Saddle Brook, NJ 07663 | ||||||||||

| (1) | Charles F. Howard is the trustee of the Morris Children Heritage Trust (the “MCH Trust”), established effective December 27, 2012, by Malcolm S. Morris. Both Malcolm S. Morris and Charles F. Howard disclaim beneficial ownership of any securities held by MCH Trust. See additional discussion in the paragraph immediately following the footnotes to this table. |

| (2) | The 2012 Stewart Morris Jr. Family Trust (the “2012 SMJ Trust”) is the general partner of Stewart Security Capital |

| (3) |

| (4) | Dimensional Fund Advisors LP reported sole voting power with respect to 1,716,885 of such shares and sole dispositive power with respect to all of such shares in its report on Schedule 13G filed February |

| (8) | Bulldog Investors LLC reported sole voting and dispositive powers with respect to 587,587 of such shares and shared voting and dispositive powers with respect to 566,702 of such shares in its report on Schedule |

Our Class B Stockholders are parties to certain agreements requiring, among other things, that the Class B Stockholders maintain a certain balance in their percentage ownership of the shares of Class B Stock. Such agreements also provide for rights of first refusal among the holders with respect to Class B Stock in the event of the death of a holder of Class B Stock, the voluntary or involuntary disposition of Class B Stock and upon certain other specified conditions. In 2012, by agreement among the holders, Malcolm S. Morris transferred 246,852 shares of Class B Stock to MCH Trust, and Stewart Morris, Jr. transferred 495,006 shares of Class B stock to SSCLP. The transfer of shares from Malcolm S. Morris to the MCH Trust and from Stewart Morris, Jr. to SSCLP received the consent of Malcolm S. Morris, Stewart Morris, Jr., and Matthew Morris under pre-existing disclosed agreements expiring March 1, 2020, that prohibit conversion of the Class B shares to Common stock. All holders of Class B Stock have agreed that all such Class B Stock shall remain subject to all the terms of the existing agreements. Malcolm S. Morris, MCH Trust, and Matthew W. Morris collectively own 50% of the Class B Stock, and Stewart Morris, Jr. and SSCLP collectively own 50% of the Class B Stock.

The following table sets forth information as of March 1, 20132, 2015 with respect to each class of our capital stock beneficially owned by our named executive officers, directors and nominees for director, and by all our executive officers, directors and nominees for director as a group:

Name | Title of Class | Amount and Nature of Beneficial Ownership(1) | Percent of Class | Title of Class | Amount and Nature of Beneficial Ownership(1) | Percent of Class | ||||||||||||

Matthew W. Morris | Common Stock | 64,120(2) | * | Common Stock | 81,210 | (2) | * | |||||||||||

| Class B Common Stock | 250,000 | 23.8 | Class B Common Stock | 250,000 | 23.8 | |||||||||||||

J. Allen Berryman | Common Stock | 33,671(3) | * | Common Stock | 38,507 | (3) | * | |||||||||||

Glenn H. Clements | Common Stock | 30,126(4) | * | Common Stock | 32,184 | (4) | * | |||||||||||

Steven M. Lessack | Common Stock | 10,522(5) | * | Common Stock | 15,136 | (5) | * | |||||||||||

Jason R. Nadeau | Common Stock | 19,087(6) | * | Common Stock | 25,391 | (6) | * | |||||||||||

Catherine A. Allen | Common Stock | 14,852 | * | |||||||||||||||

Arnaud Ajdler | Common Stock | 330,942 | (7) | 1.4 | ||||||||||||||

Thomas G. Apel | Common Stock | 18,970 | * | Common Stock | 22,360 | * | ||||||||||||

Glenn C. Christenson | Common Stock | 30,963 | * | |||||||||||||||

Robert L. Clarke | Common Stock | 36,029 | * | Common Stock | 42,563 | * | ||||||||||||

Paul W. Hobby | Common Stock | 21,567 | * | Common Stock | 25,997 | * | ||||||||||||

Dr. E. Douglas Hodo | Common Stock | 24,977 | * | |||||||||||||||

Malcolm S. Morris. | Common Stock | 114,188(7) | * | |||||||||||||||

Laurie C. Moore | Common Stock | 24,232 | * | |||||||||||||||

Malcolm S. Morris | Common Stock | 87,010 | (8) | * | ||||||||||||||

| Class B Common Stock | 28,154 | 2.7 | Class B Common Stock | 28,154 | 2.7 | |||||||||||||

Stewart Morris, Jr. | Common Stock | 107,320(8) | * | Common Stock | 73,142 | (9) | * | |||||||||||

| Class B Common Stock | 30,000 | 2.9 | Class B Common Stock | 30,000 | 2.9 | |||||||||||||

Laurie C. Moore | Common Stock | 20,842 | * | |||||||||||||||

Dr. W. Arthur Porter | Common Stock | 23,248 | * | Common Stock | 26,638 | * | ||||||||||||

All executive officers, directors and nominees for director as a group (16 persons) | Common Stock | 567,262 | 2.8 | Common Stock | 856,275 | 3.7 | ||||||||||||

| Class B Common Stock | 308,154 | 29.3 | Class B Common Stock | 308,154 | 29.3 | |||||||||||||

| * | Less than 1%. |

| (1) | Unless otherwise indicated, the beneficial owner has sole voting and dispositive power with respect to all shares indicated. |

| (2) | Includes 1,600 shares subject to stock options, |

| (3) | Includes |

| (4) | Includes 6,000 |

| (5) | Includes |

| (6) | Includes |

| (7) |

| (8) | Includes |

| (9) | Includes 6,000 shares of restricted stock. |

The mailing address of each director and executive officer shown in the table above is c/oin care of Stewart Information Services Corporation, 1980 Post Oak Boulevard, Suite 800, Houston, Texas 77056.

Section 16(a) Beneficial Ownership Reporting Compliance

Each of our directors and certain officers are required to report to the U.S. Securities and Exchange Commission (the “SEC”), by a specified date, his or her transactions related to our Common Stock or our Class B Stock. Based solely on a review of the copies of reports furnished to us or written representations that no other reports were required, we believe that all filing requirements applicable to our executive officers, directors and greater-than 10% beneficial owners were met during 2012, except as follows: Matthew Morris failed to timely three reports covering four transactions, Allen Berryman failed to timely file two reports covering two transactions, Malcolm S. Morris failed to timely file two reports covering two transactions, Stewart Morris, Jr. failed to timely file two reports covering two transactions, Michael Skalka failed to timely file one report covering one transaction, Jason R. Nadeau failed to timely file two reports covering two transactions, George L. Houghton failed to timely file two reports covering two transactions, and Glenn H. Clements failed to timely file two reports covering two transactions.2014.

ELECTION OF DIRECTORS

At our annual meeting, our stockholders will elect nine directors, constituting the entire board of directors. Our Common Stockholders are entitled to elect five directors, and our Class B Stockholders are entitled to elect four directors. The Chairman of the board of directors is elected by the boardBoard following the annual meeting of stockholders. Our Class B Stockholders are entitled to nominate and elect the person to serve as Chairman of the board of directors.

Common Stockholders’ Nominees

The following persons have been nominated by the board of directors to be elected as directors by our Common Stockholders. The persons named in your proxy intend to vote the proxy for the election of each of these nominees, unless you specify otherwise. Although we do not believe that any of these nominees will become unavailable, if one or more should become unavailable before the meeting, your proxy will be voted for another nominee, or other nominees, selected by our board of directors.

Nominee, Age and Position with Stewart | Director Since | |||

| ||||

| ||||

Glenn C. Christenson, 65, Director | 2014 | |||

Robert L. Clarke, | 2004 | |||

Laurie C. Moore, | 2004 | |||

Dr. W. Arthur Porter, | 1993 | |||

Each of the five nominees for election by ourthe Common Stockholders was elected by the Common Stockholders at our 20122014 annual meeting of stockholders.

Dr. HodoMr. Arnaud Ajdler has served as the managing partner of Engine Capital L.P., a value-oriented investment firm focused on companies going through changes, since February 2013. He was previously a partner at Crescendo Partners, a value-oriented activist investment firm, from 2005 to 2013. Mr. Ajdler is also an adjunct professor of Value Investing at the Columbia Business School. He also serves as Chairman of the board of directors. Dr. Hodo served as President of Houston Baptist University for more than 19 years and became President Emeritus of the University in 2006. Dr. Hodo served on the board of directors of U.S. Global Investors, a public mutual fund, from 1981 to 2006, including holding the positions of Chair of the Audit Committee from 1991 to 2004 and Chairman of the board of directors of Destination Maternity, Inc.

Mr. Ajdler served as a director of Charming Shoppes, Inc. from 19992008 until June 2012; O’Charley’s Inc. from March 2012 until April 2012; and The Topps Company from August 2006 until October 2007. Mr. Ajdler received a Bachelor of Science in mechanical engineering from the Free University of Brussels, Belgium, a Master of Science (SM) in Aeronautics from the Massachusetts Institute of Technology (MIT) and a Master of Business Administration from Harvard Business School.

Qualifications : Mr. Ajdler’s significant experience in value-oriented investing offers focused knowledge of businesses and their fundamentals, providing insight on elements that will strengthen the intrinsic value of the Company’s stock. His participation on boards in the retail, restaurant and consumer-goods industries provides further expertise in management and consumer-facing activities.

Mr. Glenn C. Christenson has been managing director of Velstand Investments, LLC, a private investment management company, since 2004. Between 1989 and 2007, Mr. Christenson held various positions, including Director, Chief Financial Officer, Chief Administrative Officer, and Executive Vice President as well as other management roles at Station Casinos, Inc., (now Station Casinos LLC), a gaming entertainment company. Prior to 2004. that, Mr. Christenson was a partner of Deloitte Haskins & Sells (now Deloitte & Touche LLP) from 1983-1989, with duties as partner-in-charge of Audit Services for the Nevada Practice and National Audit Partner for the Hospitality Industry.

He served onas a director of NV Energy from 2007-2013, where he served as Chairman of the board of directors of Southern National Bank of Sugar Land, Texas, from 1995 to 2000,Audit Committee and wasas a member of its Audit Committee during that tenure. Dr. Hodo also served on the board of directors of Security Bank of Amory, Mississippi, from 1994 to 2003Compensation and on their Audit and Long-Range Planningother Committees.

Ms. Allenserves as Chair of the Technology Advisory Committee. Ms. Allen is currently serving as Chairman and Chief Executive Officer of The Santa Fe Group, a strategic consulting company that serves the financial sector in the areas of payments, fraud, information security and regulatory reform. Until 2007, Ms. Allen served as founding Chief Executive Officer of BITS, a consortium of the 100 largest financial services companies in the United States, which led the industry in developing best practices and strategies for the industry in fraud prevention, cybersecurity, business continuity, anti-terrorism, payments and e-commerce. Ms. Allen is Mr. Christenson was a director of El Paso Electric Company, serving on its Compensation, External Affairs and Energy and Natural Resources Committees. Ms. Allen is also a director at SynovusFirst American Financial Corporation serving on its Riskfrom 2008 until 2011, where he served as Chairman of the Audit Committee. He served as director of Tropicana Entertainment, Inc. during 2010. Mr. Christenson is a Certified Public Accountant (“CPA”) and Nominationholds an undergraduate degree in Business Administration from Wittenberg University and Governance Committees. In addition, she is onMaster of Business Administration in Finance from The Ohio State University.

Qualifications: Mr. Christenson’s distinguished career as a CPA and range of roles in financial management provide in-depth understanding of practices and procedures regarding the advisory board of Houlihan LokeyCompany’s financial and risk management interests. His significant experience and honors in the gaming, hospitality and energy industries offer a number of nonprofit boards.unique business perspective to advancing the Company.

Mr. Robert L. Clarke serves as Chair of the Audit Committee. Mr. Clarke has beenHe is a partnerSenior Partner in the Houston office of the law firm Bracewell & Giuliani, LLP, for more thanwhere he founded the past five years.law firm’s national and international financial services practice. Mr. Clarke was appointed as U.S. Comptroller of the Currency by President Ronald Reagan in 1985, and served until 1992 under Presidents Reagan and George H. W. Bush. He has extensive experience in bank ownership and operation, and expert knowledge of banking laws, regulations and supervision, both in the U.S. and internationally.

Mr. Clarke has served as a consultant to the World Bank, and senior advisor to the President of the National Bank of Poland. He also serves as a director and member of the Audit Committeeand Nominating and Corporate Governance Committees of the boardsboard of Eagle Materials Inc., a NYSE-listed manufacturer of building materials, and asmaterials. He is a director, Chair of the Risk Committee, and member of the Investment Committee for Mutual of Omaha Insurance Company. He is also a director of Community Bancshares of New Mexico, Inc. and Community Bank in Santa Fe, New Mexico, and a director of the Dubai Financial Services Authority. Mr. Clarke has served as U.S. Comptrollera Trustee of Rice University from which he received its Distinguished Alumnus award, and continues to serve as a Trustee Emeritus and member of its Audit and Public Affairs Committees. Additionally, Mr. Clarke is a Trustee of the CurrencySanta Fe Chamber Music Festival and its supporting Foundation, an Advisory Trustee of the Museum of New Mexico Foundation, a Trustee of the Financial Services Volunteer Corps, and a Trustee of the National Foundation for Credit Counseling. He received a Bachelor of Arts in economics from December 1985 through February 1992.Rice University, and an LL.B. from Harvard Law School.

Qualifications: Mr. Clarke is a veteran attorney and banking professional with extensive experience in legal, regulatory and corporate governance matters. His tenure in the U.S. government, along with his in-depth knowledge of banking and finance, provide valued expertise to the Company.

Ms. Laurie C. Mooreserves as Chair of the Compensation Committee. Ms. MooreShe is the founding Chief Executive OfficerFounder and President of the Institute for Luxury Home Marketing, an international training and membership organization targeting real estate agents who work in the luxury residential market (the “Institute”).market. For the 12 years prior to founding the Institute in 2003, Ms. Moore was Managing Partner of RealREAL Trends, Inc., a publishing, research, and strategic consulting company serving brokerage company owners and the top management of national real estate franchise brands. She

With nearly 40 years in the real estate space, Ms. Moore has been an industrya featured speaker for more than 25 years. In the area of governance, she has presented at events, including the 2014 ISS Annual Client Conference, the 2013 Harvard Law School Roundtable on Executive Compensation, and the 2015 and 2012 NYSE Compensation Boot Camps. She isearned a National Association of Corporate Directors Board Fellow.Fellow designation in 2012; in the same year, she was also chosen as one of five top Texas businesswomen by the Texas Women’s Chamber of Commerce. As Executive Director of two residential brokerage CEO groups, she gained financial experience through more than 10 years of supervising the preparation of combined financial summaries for Chief Executive Officer peer review for dozens of major real estate firms.

Qualifications: As a founder of three businesses serving the residential brokerage industry, Ms. Moore’s experience provides keen insight on the Company’s customer base, particularly REALTORS® and affluent

consumers. She also has a deep understanding of the industry’s structure and is familiar with its major players. Ms. Moore brings a pragmatic and strategic approach to business challenges, and is valuable in assessing the expertise, knowledge and experience of potential director nominees.

Dr. W. Arthur Porterserves as Chair of the Nominating and Corporate Governance Committee. Dr.Mr. Porter is President of Quantum, Inc., an education and technology consulting company. He has been a Professor Emeritus of engineering at the University of Oklahoma since 2007; before his retirement, he was a University Professor and Regents Chair of Engineering. He recently served as Associate Dean, College of Natural Science, at Thethe University of Texas at Austin,(UT), Research Professor, and Acting Director and Department Chair of the University of TexasUT Marine Science Institute from 2011 to 2012. Prior to his retirement from the University of Oklahoma, he served as University Professor and Regents Chair of Engineering at that university. From 1998 to 2006, he served as University of Oklahoma Vice President for Technology Development, and also served as Dean of the College of Engineering from 1998 to 2005.

Prior to those appointments, he had served asDr. Porter was Founding President and Chief Executive Officer of Houston Advanced Research Center, a nonprofit research consortium, for more than five years.from 1985 to 1998. He also served aswas an Adjunct Professor of Electrical Engineeringelectrical engineering at Rice University for more than five years, priorand served in a range of educational and directorial capacities at universities in the U.S. and worldwide. Dr. Porter served as the Chairman of the board of directors for Southwest Nanotechnology from 2003 to his appointment with2008, and has been a member of numerous technology and banking boards. He holds a Bachelor of Science and Master of Science in Physics from the University of Oklahoma.North Texas, and a Ph.D. in Interdisciplinary Engineering from Texas A&M University.

Qualifications: Dr. Porter has extensive knowledge and experience in technology, strategic planning, executive management and intellectual property matters. He also has extensive experience in IPOs on both foreign and domestic exchanges, as well as M&A activity. His long-term management experience and participation in various boards of directors were instrumental in the Company’s recent reorganization, making him a key asset to continued growth and development.

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR THE ELECTION OF THE FIVE NOMINEES FOR DIRECTOR.

Class B Common Stockholders’ Nominees

The following persons have been nominated as directors to be elected by our Class B Stockholders. The persons named in the Class B Stockholders’ proxies intend to vote the proxies for the election of the nominees named below, unless otherwise specified. Although we do not believe that any of these nominees will become unavailable, if one or more should become unavailable before the meeting, proxies will be voted for another nominee, or other nominees, selected by the Class B Stockholders.

Nominee, Age and Position with Stewart | Director Since | |||

Thomas G. Apel, | 2009 | |||

| ||||

Malcolm S. Morris, | 2000 | |||

Stewart Morris, Jr., | 2000 | |||

Each of these nomineesThomas G. Apel, Gov. Frank Keating, Malcolm S. Morris and Stewart Morris, Jr. was elected as director by our Class B Stockholders at our 20122014 annual meeting of stockholders.

Mr. ApelThomas G. Ape currently serves asl is the Chairman of the board of directors. He is Chief Executive Officer of VLN, Inc., a non-conforming mortgage lending operation located in Edmond, Oklahoma. He is also a research affiliate with the Massachusetts Institute of Technology, currently focused on business model taxonomy and IT portfolio strategies. From 2006 until January 1, 2013, heMr. Apel was President of Intrepid Ideas Inc., a product development, technology evaluation and business strategy consulting firm for financial services and real estate finance companies.

Prior to 2006, he served as President and Chief Executive Officer of Centex Title and Ancillary Services, and was responsible for management, strategy development and implementation of a highly profitable business unit containing national title, escrow, title insurance and property and casualty insurance operations. His background also includes extensive experience in mortgage lending and related real estate lending operations.

Qualifications:Mr. Apel has significant knowledge and experience in the mortgage, title, insurance and technology industries, as well as in corporate management, strategy, finance and start-up businesses. His familiarity with mortgage and other real estate lending provides a useful perspective on one of the Company’s essential customer segments.

Mr. HobbyGov. Frank Keatingis founding ChairmanPresident and CEO of Genesis Park, L.P., a Houston-based private equity business specializingthe American Bankers Association. He was previously President and CEO of the American Council of Life Insurers. From 1995 to 2003, he served as Governor of the State of Oklahoma, the second person to hold the office for two consecutive terms. As Governor, he was recognized for his compassionate, professional handling of the Murrah Federal Building bombing in energy technologyOklahoma City, after which he raised over $6 million for the education of children whose parents were killed in the tragedy.

Gov. Keating’s career has included time as an FBI agent, U.S. Attorney, State Prosecutor, and communications investments.member of Oklahoma’s state House and Senate. He served from 2004 through 2011 asin the Chief Executive Officer of Alpheus Communications, Inc.federal Treasury, Justice and Housing departments under Presidents Reagan and George Bush, Sr., a Texas wholesale telecommunications provider,with responsibility for federal prosecutions and from 2002 to 2006, as Chairman of CapRock Services, Inc.,oversight over the largest provider of satellite services to

the global energy business. Mr. Hobby previously served on the boards ofSecret Service, U.S. Customs, U.S. Marshals, U.S. Attorneys and several publicly traded companies and currently serves on the board of NRG Energy, Inc. Mr. Hobby is Chairmanother agencies. As Assistant Secretary of the Houston BranchTreasury and General Counsel and Acting Deputy Secretary of the Federal ReserveU.S. Department of Housing and Urban Development (HUD), he worked on issues including housing finance, lending practices, securitization and Bank Secrecy Act issues.

Gov. Keating is a graduate of Dallas, Chairman-electGeorgetown University and the University of Oklahoma College of Law, and the Greater Houston Partnership,recipient of six honorary degrees. He is a frequent commentator on national news programs, and is a member of the Texas Ethics Commission.boards of the National Archives, the Jamestown Foundation and the Bipartisan Policy Center.

Qualifications: Gov. Keating’s lengthy public service career provides a depth of knowledge in government, legal, banking, directorial and infrastructure matters. With the numerous fiscal concerns facing the world economy and the housing industry in particular, he draws on considerable experience to advise the Board on Company interests.

Mr. Malcolm S. Morrishas served as is a Vice Chairman of the Company, since November 2011,previously Chairman of the board of directors and Co-Chief Executive Officer from 2000 until November 2011, and Senior Executive Vice President—President��Assistant Chairman for more than five years prior to that time. Malcolm S. Morris has2000. He is also served for more than the past five years as Chairman of the board of Stewart Title Guaranty Company.

His personal experience as a Company employee spans more than four decades, including responsibility for financial stability and efficiency improvements. He is the first cousin of Vice Chairman Stewart Morris, Jr. and father of Company Chief Executive Officer and Advisory Director Matthew W. Morris.

Mr. Malcolm Morris has more than 40 years of experience in the title insurance industry, and has served as President of the Texas Land Title Association and the American Land Title Association. He is a member and fellow of the American Bar Association and the Houston Bar Association, and a member of the State Bar of Texas. Mr. Malcolm Morris has a Master of Business Administration with a focus on finance and banking, and a Juris Doctorate from the University of Texas. He also attended the Harvard Law School’s Program of Instruction for Lawyers.

Qualifications: As a member of the Company’s founding family, with more than 40 years of tenure, Mr. Malcolm Morris has intimate knowledge of the Company’s operations, legal and regulatory matters, history and culture. His highly respected leadership and involvement in title industry organizations and advocacy are essential to the Company’s position as a leader in the market.

Stewart Morris, Jr. is a Vice Chairman of the Company, since November 2011 and, prior to that, aspreviously President and Co-Chief Executive Officer from 2000 until November 2011. StewartMr. Morris, Jr. has also served as Presidentpresident and Chief Executive Officerchief executive officer of Stewart Title Company, and Chairmanchairman or Senior Chairmansenior chairman of the board of Stewart Title Guaranty Company, since 1991. He has been a Company employee for more than 40 years, and has been responsible for the development of a number of real estate services and technology solutions, including productivity, e-commerce and settlement, related lender services, automated land record systems, courthouse automation and international land registries. He is the first cousin of Vice Chairman Malcolm S. Morris.

Mr. Morris, Jr. is a director of the American Land Title Association, and received the October Research 2012 Joe Casa Award in recognition of his leadership in industry innovation. In 2012, Mr. Morris, Jr. was named one of the 100 most influential real estate leaders by Inman News. With his in-depth knowledge of real estate transactions and affiliated technology, Mr. Morris, Jr. speaks frequently at industry conferences, universities and other forums. Mr. Morris, Jr. is chairman of the Oldham Little Foundation, which gives approximately 100 grants per year to small churches worldwide. For the past ten years, Mr. Morris, Jr. has served as chairman of the Carriage Museum of America, and currently serves as treasurer. He has a Bachelor of Arts in economics and political science from Rice University, and a Master of Business Administration with a focus on finance and real estate from the University of Texas.

Qualifications: As a member of the Company’s founding family, with more than 40 years of tenure, Mr. Morris, Jr. has intimate knowledge of the Company’s operations, technology interests, expansion strategy, management, history and culture. His significant expertise in real estate information technology and the transaction process has been key to the Company’s market leadership.

Malcolm S. Morris and Stewart Morris, Jr. are first cousins. Matthew W. Morris is the son of Malcolm S. Morris.

Board of Directors

We are managed by a board of directors comprised of nine members, five of whom are elected by our Common Stockholders and four of whom are elected by our Class B Stockholders. A majority of the members of the board of directors are “independent” within the meaning of the listing standards of the NYSE. TheseAssuming the election of the 2015 director slate set described above, these directors are: E. Douglas Hodo, Chairman of the board of directors, Catherine A. Allen, Thomas G. Apel, Gov. Frank Keating, Glenn C. Christenson, Arnaud Ajdler, Robert L. Clarke, Laurie C. Moore and Dr. W. Arthur Porter. The board of directors has determined that none of these directors has any material relationship with us or our management that would impair the independence of their judgment in carrying out their responsibilities to us. In making this determination, the board of directors considers any transaction, or series of similar transactions, or any currently proposed transaction, or series of similar transactions, between us or any of our subsidiaries and a director to be material if the amount involved exceeds $120,000, exclusive of directors’ fees, in any of our last three fiscal years.

The roles of Chairman of the board of directors and Chief Executive Officer are separate and each role is held by a different individual. The Chairman of the board of directors is elected by the boardBoard following the annual meeting of stockholders. Our Class B Stockholders are entitled to nominate the person to serve as Chairman of the board of directors. As discussed below, Dr. Hodothe Chairman also presides over the regular and any special meetings of our non-management directors. Our non-management directors meet prior to each regularly scheduled board meeting.

All of our directors shall be elected at the annual meeting of stockholders and hold office until the next annual election or until his or her successor shall be electedchosen and shall be qualified, or until his or her death or the effective date of his or her resignation or removal for cause. The act of six of the directors shall be the act of the board of directors except as may be otherwise specifically provided by statute, by the Certificate of Incorporation, or by the Company’s Amended and Restated By-Laws.

In 2014, the Company adopted a majority voting standard which raised the standard for election to the board of directors such that votes cast for such director must exceed the votes cast against such director in an uncontested election. In connection with the majority voting standard, the board of directors at the same time approved a guideline requiring the resignation of a director who fails to receive a majority vote in an uncontested election. Under the new 2014 By-Law, in a contested election (i.e., where the Secretary of the Corporation determines that the number of nominees exceeds the number of directors to be elected as of the date seven days prior to the scheduled mailing date of the proxy statement for such annual meeting of stockholders), the plurality voting standard would still apply. Because Bulldog has advised the Company of its intention to nominate five alternative director nominees for election at the 2015 Annual Meeting, the standard for election of directors to the Board at the 2015 Annual Meeting will be a plurality vote if Bulldog proceeds with nominating five alternative director nominees. During 2012,2014, the board of directors held five4 regular meetings, two6 special meetings, one retreat, and executed three14 consents in lieu of meetings. Each directorAll directors attended eachall of such meetings, except that at two of such regular meetings only eight ofthree directors each missed one meeting. For 2015, the nine directors were in attendance. The board of directors haswill have an Executive Committee, an Audit Committee, a Nominating and Corporate Governance Committee, a Compensation Committee and a Technologyan Advisory Committee.Committee on Cost Management. See “Committees of the Board of Directors” below.

The board of directors has adopted theStewart Code of Business Conduct and Ethics, Guidelines on Corporate GovernanceandCode of Ethics for Chief Executive Officers, Principal Financial Officer and Principal Accounting Officer, each of which is available on our website atwww.stewart.com/investor-relations/corporate-governanceand in print to any stockholder who requests it. We intend to disclose any amendment to or waiver under ourCode of Ethics for Chief Executive Officers, Principal Financial Officer and Principal Accounting Officerby posting such information on our website. OurGuidelines on Corporate Governanceand the charters of the Audit Committee, the Nominating and Corporate Governance Committee, the Compensation

Committee, and the Executive Committee require an annual self-evaluation of the performance of the board of directors and of such committees, including the adequacy of such guidelines and charters. The charters of the Nominating and Corporate Governance Committee, the Audit Committee, and the Compensation Committee, the Executive Committee and the Advisory Committee on Cost Management are available on our website atwww.stewart.com/investor-relations/corporate-governanceand in print to any stockholder who requests them. OurGuidelines on Corporate Governancestrongly encourages attendance in person by our directors at our annual meetings of stockholders. All of our directors attended our 20122014 annual meeting of stockholders.

Director Qualifications

Each of our directors is an individual of high character and integrity, with an inquiring mind, and works well with other members of the board of directors and our management team.others. Each director nominee brings a unique background and set of skills to the board, giving the board of directors, as a whole, competence and experience in

a wide variety of areas, including insurance, real estate, technology, strategic planning, corporate governance, executive management, accounting, finance, government and international business. The following is a discussion of the particular experience, qualifications, attributes and skills of each of our director nominees that are considered important by the board of directors.

Catherine A. Allen.Ms. Allen has extensive knowledge and experience in technology, financial services and public policy, as well as significant corporate management experience. Her company, The Santa Fe Group, and former employer, BITS, are responsible for developing industry best practices in risk management. She also has experience in establishing best practices and standards for information security and fraud prevention, and has extensive experience and contacts in the regulatory environment at a federal and New Mexico state level.

Thomas G. Apel.Mr. Apel has significant knowledge of and experience in both the mortgage and title industries. Mr. Apel also has extensive experience in technology and start-up businesses.

Robert L. Clarke.Mr. Clarke has extensive experience in business, government, banking, and legal and regulatory matters.

Paul W. Hobby.Mr. Hobby has extensive experience in private equity and mergers and acquisitions, as well as significant experience in public affairs.

Dr. E. Douglas Hodo.Dr. Hodo has extensive experience in administration and finance matters. He has a Ph.D. in economics and finance with over 30 years’ experience in financial risk assessment and analysis as both a consultant and professor.

Laurie C. Moore.Ms. Moore has a broad understanding of the real estate business developed during a more than 35-year career in the industry. She brings to the board strategic marketing skills, honed as an industry researcher and consultant to top management, and has experience as a founder and top executive of three successful businesses serving the residential brokerage industry. As Executive Director of two residential brokerage Chief Executive Officer groups, she gained functional financial experience, including more than 10 years supervising and coordinating preparation of combined financial summaries for 12 major firms in the real estate industry for Chief Executive Officer peer review. Ms. Moore is invaluable in assessing the subject matter expertise, knowledge, background and experience of potential director nominees. She is a National Association of Corporate Directors Board Fellow.

Malcolm S. Morris.Malcolm S. Morris has over 40 years of experience in the title insurance industry and has served as President of the Texas Land Title Association and the American Land Title Association. Having worked for the Company for over four decades, he has intimate knowledge of the Company and its legal and regulatory matters. He has a J.D. and a Masters of Business Administration with a focus on finance and banking.

Stewart Morris, Jr.Stewart Morris, Jr. has over 40 years of experience in the title insurance industry and has intimate knowledge of the Company. Stewart Morris, Jr. is also an expert in real estate information technology, including technologies related to productivity, e-commerce and settlement services, and has led the Company’s expansion into related lender services, automated land record systems, courthouse automation and international land registries. He has a Bachelor of Arts degree. in economics and political science from Rice University and a Masters of Business Administration with a focus on finance and real estate from The University of Texas.

Dr. W. Arthur Porter.Dr. Porter has extensive knowledge and experience in technology and intellectual property matters. Dr. Porter also has significant administrative and board experience and, as Chair of our Nominating and Corporate Governance Committee, was instrumental in the Company’s recent reorganization.

For additional information regarding the qualifications, background and experience of our director nominees, please see each nominee’s biographical information under Proposal“Proposal No. 1.1”.

Risk Oversight

The board of directors has ultimate responsibility for protecting stockholder value. Among other things, the board of directors is responsible for understanding the risks to which we are exposed, approving management’s strategy to manage these risks, and monitoring and measuring management’s performance in implementing the strategy. The board of directors works with its committees and management to effectively implement its risk oversight role.

The Audit Committee, with the assistance of management, oversees the risks associated with the integrity of our financial statements, our compliance with legal and regulatory requirements, and our liquidity requirements and other exposures to financial risk. The Audit Committee reviews with management, independent auditors and internal auditors (the internal audit function has been outsourced to Deloitte & Touche LLP) the accounting policies, the system of internal controls and the quality and appropriateness of disclosure and content in the financial statements or other external financial communications. The Audit Committee, with the assistance of our legal department and human resources department, also performs oversight of our various conduct and ethics programs and policies, including theStewart Code of Business Conduct and Ethics, reviews these programs and policies to assure compliance with applicable laws and regulations, and monitors the results of our compliance efforts. To the extent the Audit Committee identifies any material risks or related issues, the risks or issues are addressed with the full board of directors.

The Nominating and Corporate Governance Committee, with the assistance of management, oversees risks associated with administering ourGuidelines on Corporate Governanceand is responsible for reviewing and making recommendations for selection of nominees for election as directors by Common Stockholders. To the extent the Nominating and Corporate Governance Committee identifies any material risks or related issues, the risks or issues are addressed with the full board of directors.

The Compensation Committee, with the assistance of management, oversees risks associated with our compensation programs and policies. To the extent the Compensation Committee identifies any material risks or related issues, the risks or issues are addressed with the full board of directors.

The Technology Advisory Committee, with the assistance of management, oversees risks associated with matters relating to information security, IT controls, business continuity, disaster recovery and other risk-management activities. To the extent the Technology Advisory Committee identifies any material risks or related issues, the risks or issues are addressed with the full board of directors.

Advisory Directors

In addition to the directors elected by our Common Stockholders and Class B Stockholders, from time to time our board of directors appoints advisory directors. These individuals are selected based on their potential as future candidates for our board of directors. This gives potential director candidates the opportunity to learn

firsthand about the Company and provides a bench of candidates who have gone through the learning curve regarding the Company, its products, policies and business practices. If elected, they are ready to fully engage as directors. Governor Frank Keating, President and CEO of the American Bankers Association, and Matthew W. Morris, the Company’s Chief Executive Officer (“CEO”), currently serve as advisory directors. Our advisory directors receive notice of and regularly attend meetings of our board of directors and committees on which they serve as non-voting members. They provide valuable insights and information, but are not included in quorum and voting determinations. Non-employee advisory directors receive the same compensation for their services as our elected directors receive. Employee advisory directors do not receive any pay as an advisory director (see Footnote 1, Page 38).director. All advisory directors attend meetings at the pleasure of the board.Board. Paul W. Hobby, founding Chairman of Genesis Park, L.P., and Matthew W. Morris, the Company’s Chief Executive Officer (“CEO”), currently serve as advisory directors.

Committees of the Board of Directors

TheFor 2015, the board of directors of the Company haswill have the following committees: Executive, Audit, Nominating and Corporate Governance, Compensation and Technology Advisory.Advisory Committee on Cost Management.

Executive Committee.The Executive Committee may exercise all of the powers of the board of directors, except those specifically reserved to the board of directors by law, by resolution of the board of directors, or by the Executive Committee Charter. The Executive Committee currently consists of Thomas G. Apel (Chair), Glenn C. Christenson, Robert L. Clarke, Paul W. Hobby, Malcolm S. Morris and Stewart Morris, Jr. During 2012,2014, the Executive Committee held five3 meetings, at which all members were present, except that one director missed one meeting, and executed thirteen13 consents in lieu of meetings. The Executive Committee operates under a charter adopted by our board of directors, a copy of which is available on our website atwww.stewart.com/investor-relations/corporate-governance.

Audit Committee.It is the Audit Committee’s duty to assist the board of directors in fulfilling its oversight responsibility of (i) the integrity of the financial statements of the Company, (ii) the independent auditors’ qualifications, independence, and performance, (iii) the Company’s system of controls over financial reporting, performance of its internal audit function, independent auditors, and compliance with ethical standards adopted by the Company, and (iv) the compliance by the Company with legal and regulatory requirements. The Audit Committee has sole authority to appoint or replace our independent auditors. The Audit Committee has the authority to engage independent counsel and other advisers as it determines necessary to carry out its duties. The Audit Committee operates under a written charter adopted by our board of directors, a copy of which is available on our website atwww.stewart.com/investor-relations/corporate-governance. The Audit Committee currently consists of Robert L. Clarke (Chair), Thomas G. Apel, and Laurie C. Moore.Moore, and Glenn C. Christenson. During 2012,2014, the Audit Committee held eight8 regular meetings, at which all members were present, except that attwo members each missed one of such regular meetings only two of the three directors were in attendance.meeting. Each of the members of the Audit Committee is “independent” as defined under the listing standards of the NYSE and the Securities Exchange Act of 1934, and the board of directors has determined that Mr. Clarke is an “audit committee financial expert” as defined in the rules of the Securities and Exchange Commission.SEC. No member of our Audit Committee serves on the audit committees of more than three public companies.